Affiliate disclosure: Automoblog and its partners may be compensated when you purchase the products below.

Based on the number of direct premiums written, State Farm is the largest personal auto insurer in the country, but is it the best choice for you? In this article, we’ll take a look at State Farm auto insurance reviews, policy options, discounts, costs, and more to help you decide.

Choosing the right insurer is key to protecting your finances after an accident. Along with State Farm, we’ve reviewed some of the best car insurance companies on the market and rated them based on their policy options, affordability, customer service, and other important factors.

Even if the company looks like the right provider for you after reading this State Farm insurance review, we always recommend getting quotes from multiple providers and comparing them before making a decision.

State Farm Overview

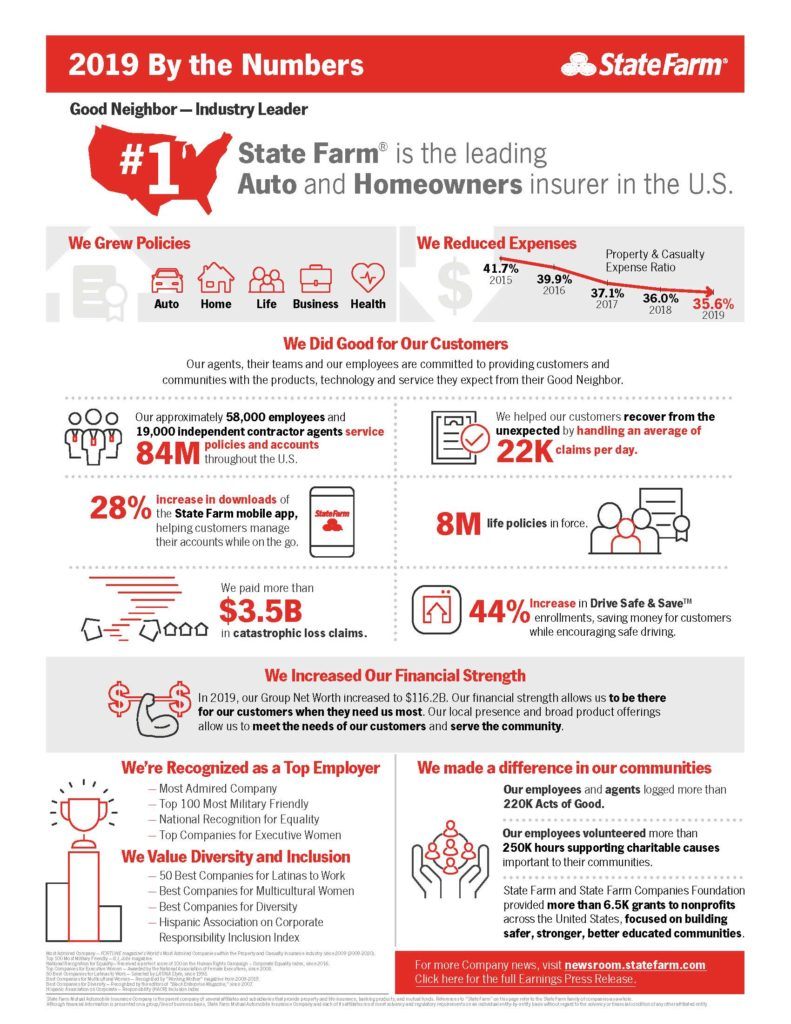

Established in 1922, State Farm is the biggest car insurance company in the U.S. In 2019 alone, State Farm wrote $40.9 billion in insurance premiums, according to the National Association of Insurance Commissioners (NAIC). This figure accounted for 16.1 percent of the market share. Since State Farm is such a large insurer, it has sound financial stability. AM Best rated the company A++ for its financial strength, indicating its superior ability to pay customer claims.

State Farm is available in 48 states, excluding Massachusetts and Rhode Island. Though State Farm has received more customer complaints than the average insurer, the high number is largely due to the company’s size. It’s difficult to insure as many drivers as State Farm without accruing some customer complaints. State Farm regularly performed above regional averages in the J.D. Power 2020 U.S. Auto Insurance Satisfaction StudySM.

In our State Farm insurance review, we named State Farm the best insurer for student drivers based on its wide-ranging discounts available to teens and students.

State Farm Auto Insurance Coverage

The type of car you own can have a major impact on the type of coverage you choose and the price you pay for your policy. We like that State Farm auto insurance can cover a wide range of vehicles, from your standard Toyota to your Porsche 911.

With State Farm, you can purchase:

- Standard collision, comprehensive, and liability insurance

- Sports car insurance

- Collector and classic car insurance

Standard Auto Insurance Coverage

Customers looking for standard insurance policies will find the following coverage options and policy add-ons:

- Liability insurance: Property damage liability policies cover the cost of damages to someone else’s vehicle, home, or personal property after an accident you cause. Bodily injury liability insurance covers the other party’s injuries, medical expenses, and lost wages.

- Collision insurance: This covers your own vehicle, whether it’s new, a temporary substitute, or a car not owned by someone in your household. This insurance pays for damage from any collision, up to the amount of your vehicle.

- Comprehensive insurance: With a comprehensive policy, you can get covered up to the amount of your vehicle for damage not related to a collision, such as a fire, civil unrest and riots, theft, vandalism, weather, or hitting an animal.

- Uninsured motorist insurance: You can choose either uninsured or underinsured motorist insurance to cover your vehicle and any potential injuries caused by a driver without insurance or with a policy that can’t adequately cover damages.

- Medical payments coverage: No matter who is at fault, medical payment insurance will cover injuries to you, your passengers, and anyone you may injure in an accident. Coverage includes pedestrian injuries and funeral costs.

- Emergency roadside assistance: This service covers the costs of mechanical labor at the breakdown site, locksmith labor if your key is lost, stolen, or locked in your vehicle, emergency fuel delivery, oil delivery, battery delivery, and flat tire changes.

- Rideshare insurance: This insurance covers you while driving for rideshare services like Lyft or Uber in three different situations: when your app is on and ready for hire, when you match with a rider, and when you transport the rider. Coverage may include property damage, liability, uninsured motorist, and rental car benefits.

- Rental car coverage: This covers the cost of a rental up to a certain amount for those who don’t have rental coverage or who have exceptionally high deductibles. If you’re in a collision in a rental car, State Farm will cover your deductible up to $500. You can also opt for travel expense coverage, which pays for meals, transportation, and lodging up to $500 if you are more than 50 miles from home.

Sports Cars & Classic Cars

Sports cars and classic cars can be very expensive to insure. Sports cars are generally fast, which is considered a potential risk, and classic cars are often expensive to repair due to the required parts.

State Farm works with customers to make sure they get a lower price for their policy and take the necessary steps to qualify for specialized insurance. But if you drive these vehicles often, you may have trouble finding affordable coverage with State Farm. This is because rates increase based on usage, and classic cars only qualify if they are mainly used for exhibition.

The Cost of State Farm Auto Insurance

Overall, J.D. Power ranks State Farm’s affordability equal to competitors like Allstate, Farmers, Liberty Mutual, and GEICO. We consider prices to be average, so if price is your main consideration, then it’s best to compare rates across different companies.

State Farm provides free, direct quotes through the quote engine on its website. In our experience, the quote engine is fast, but it’s rather bare-bones and could use some extra features, such as price comparison tools and other personal calculators.

Discounts on State Farm Auto Insurance

Not all insurance companies reward their loyal customers with discounts and other cost-saving benefits, but State Farm offers insurance discounts for customers who stick with the company and buy beyond a single-driver policy. For this reason, State Farm car insurance is a better value for customers who use State Farm for more than just vehicle coverage. Loyalty discounts include:

- Multiple vehicles: Save up to 20 percent on your insurance policy if two or more cars are insured in your household.

- Multi-policy: Save up to 17 percent on your insurance policy if you also purchase State Farm homeowners insurance, renters insurance, condo insurance, life insurance, or other insurance products and bundling them together.

Teenagers and safe drivers perhaps benefit the most from State Farm insurance. The following discounts help young drivers, their parents, and cautious drivers save money:

- Anti-theft discount: Qualify for a discount if your vehicle has an anti-theft alarm or other warning system.

- Driver training discount: Drivers under the age of 21 can get a discount for completing an authorized drivers ed program.

- Good driving discount: New State Farm customers can get an additional discount if they go three years without a moving violation or accident.

- Student away at school discount: Students under the age of 25 can qualify for a discount if they only use their car during summers and holidays.

- Defensive driving course discount: State Farm agents can provide a list of qualifying defensive driver courses that count toward a safe driving discount.

- Vehicle safety discount: Save up to 40 percent on medical payment coverage for vehicles made after 1994. That’s a large number of vehicles on the road today.

- Good student discount: Save up to 25 percent on your insurance policy for getting good grades. This discount lasts even after you finish college, up to the age of 25.

- Accident-free discount: Qualify for a discount if you avoid a chargeable accident for three years. Your discount may increase over time if you continue to use State Farm auto insurance.

- Passive restraint discount: Receive a discount up to 40 percent on medical coverage for 1993 models and older vehicles that have a factory-installed air bag or passive restraint system.

State Farm Claims Process

State Farm auto insurance claims can be made online, through the mobile app, by calling the claims department (open 24/7), or by calling your local State Farm agent. After you make a claim, State Farm will review the claim and request additional information if needed. An agent will send an estimate and repair options to you.

State Farm pays for repairs in three ways: directly to the repair facility, directly to your bank account, or directly to your mailbox through a check. Using the mobile app to make and manage a claim, pay a bill, or upload photos is very simple.

State Farm Insurance Reviews

State Farm has nearly 100 years of experience insuring drivers. The Better Business Bureau (BBB) rates State Farm with an A+ for positive business ethics and resolving customer complaints. In J.D. Power surveys, State Farm regularly performs at or above the regional average for customer satisfaction.

Positive State Farm Insurance Reviews

Customers who use multiple State Farm services tend to have good things to say about their overall experience. Take, for example, this State Farm auto insurance review by a loyal customer on Trustpilot:

“[I] love State Farm. All of my insurance, banking, and financial planning is through [State Farm]. Quick service, both at the agent’s office and on the phone. Needed a tow, they sent someone ASAP and no [money] paid out of pocket for the tow. [I] had a checking [account] question and they were available on the phone super late and to chat with online as an [instant message]. Love my agent!” – Anonymous

And another customer:

“State Farm has all my insurance business.” – James E.

Negative State Farm Insurance Review

During our research, we found customers had the most negative feedback in regard to claim and repair duration, customer service professionalism, and issues with claims in which another driver was at fault. These claims took longer on average, and customers did not always hear back promptly from their representative or agent.

Here are two examples of negative State Farm auto insurance reviews from Trustpilot:

“State Farm was a great bargain years ago. The prices skyrocket after an accident, even if you’re not at fault. The agents are great, but it is so unaffordable now. I had to cancel the policy [and] switch to Progressive.” – Emma

“I asked Thursday afternoon for proof of payment – and they hung up. Yet, I called again. Then they hung up – again. They also are beyond incompetent – two different people could not spell my email address correctly.” – Rhett W.

Apps & Technology

State Farm offers two mobile app-based programs that reward good driving habits: Drive Safe & SaveTM and Steer Clear?.

Drive Safe & Save offers up to a 30 percent discount on your insurance policy. Using a mobile app, good driving habits are monitored and rewarded. For example, State Farm rewards drivers who avoid quick accelerations, hard braking, fast cornering, speeding, and distracted driving.

Steer Clear is a safe driving program made with young drivers in mind. If you have a driver under the age of 25 on your policy, they may be eligible for this program. Through a series of courses, mentoring sessions, and practice driving hours, young drivers can earn a program certification and policy discounts. Like Drive Safe & Save, this program also uses a mobile app to monitor driving behavior.

Conclusion: Best for Student Drivers

Based on our own research and State Farm auto insurance reviews, we believe State Farm’s greatest asset is its programs for student drivers. State Farm also offers many forms of insurance, such as homeowners, condo, renters, and life insurance, which many customers bundle with their auto insurance for optimal value.

Affordability, by contrast, is not as strong. Companies like GEICO offer a better experience in that area. Learn more about competitor policies in our ranking of the best auto insurance companies.

If you are looking for insurance from a well-known brand, and you are also in the market for other lines of insurance, then consider State Farm auto insurance for your vehicle.

Is State Farm expensive?

Our research found that State Farm insurance was about average, on par with many of the other large insurance providers we reviewed. While State Farm insurance isn’t expensive compared to others, it’s also not the cheapest provider.

What is the phone number for State Farm customer service?

You can reach State Farm customer service via the customer care phone number at 888-559-1922. This customer service line is available 24 hours a day, seven days a week.

How much does car insurance drop when you turn 25?

Based on our research, we found that car insurance rates can drop as much as 20% when you turn 25. Of course, your rates also depend on your driving record, vehicle information, and several other factors.

Does State Farm cover towing?

State Farm covers towing to the nearest repair facility as part of its roadside assistance package. While this package does cost extra as a policy add-on, it may save you money if you have a roadside emergency.

What is the State Farm accident claim number?

The State Farm accident claim number is 800-732-5246 (800-SF-CLAIM). You can also file a claim from the State Farm mobile app.

Original article: Is State Farm Auto Insurance Right For You? We Did The Research

from Automoblog https://ift.tt/3BpkKa5

No comments:

Post a Comment