Rarely, if ever, have cars been an “investment” in my life. For myself and countless other gearheads around the world, cars are not a way to make money, they are a perfectly efficient way to lose money. This is not to say classic cars cannot make money in the long run . . . just that 99.99999% of the time, they end up costing you bread, not earning it. If you’re going to invest, the stock market seems more likely.

Now, it seems, some people would beg to differ.

Cash For Classics

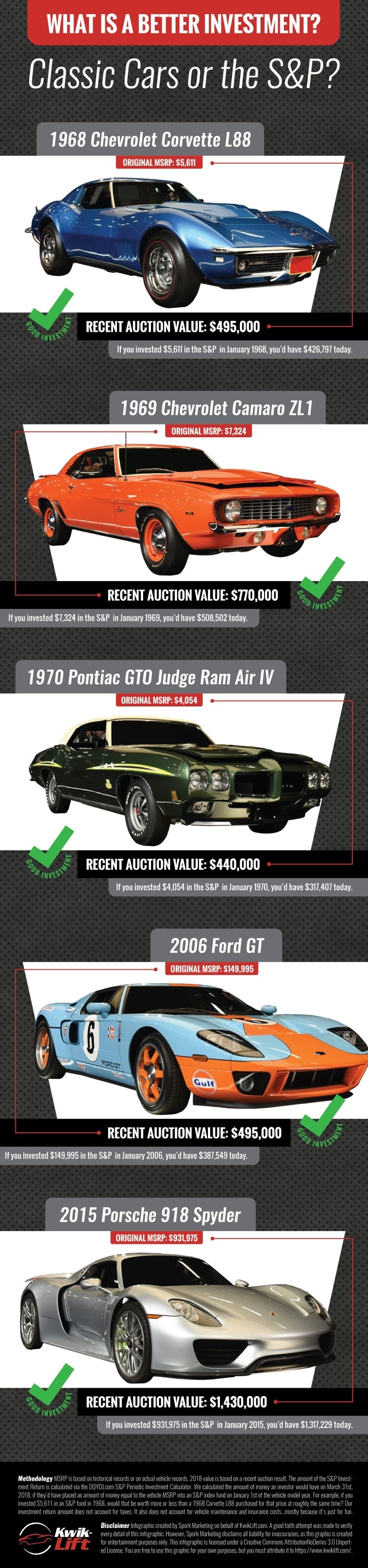

According to Kwik-Lift, manufacturers of high-strength steel home and repair shop maintenance lifts, “investing” money in certain cars is actually a good thing. Kwik-Lift says their data “proves” investing in a classic or soon-to-be classic car can offer a better return than putting money into the stock market.

Kwik-Lift bases this on five of the most expensive vehicles Barrett-Jackson sold in January. Kwik-Lift compared those sale values with what the same amount of cash would have gotten you compared with the return from the Standard & Poor’s (S&P) 500 Index. Kwik-Lift concluded that their study “verified that collector cars are indeed a solid investment.”

And it’s not just Kwik-Lift. I recently read that a German investment firm said more or less the same thing about “investing” in classic 911s. And yes, while the German’s article does jive with what Kwik-Lift is saying, it’s also worth noting that used 911 prices added another zero in the past few years, which should skew the Germans dataset a little, one would think.

What it also does is put “reasonable” 911s out of reach for average guys like me, which totally bums me out. But that’s another story.

Will the 2018 Porsche 911 GT2 RS be a classic one day? Is it worth buying now in the hopes it will increase in value in 50 years? Photo: Porsche Cars North America, Inc.

Critical Questions

I can hear my investment banker friends laughing all the way out here in the boonies. There’s a bunch of things here that would get you laughed out of an Econ 101 class at the local community college.

First off, they’re using numbers from Barrett-Jackson, an auction company. Auctions are obviously very volatile sales environments, so their sales values are always taken with a grain of salt. Two: “sold in January 2018.” A one month sample size? Three: “five of the most expensive vehicles Barrett-Jackson sold.” Five cars? And only the most expensive? Again, too small a sample and you’ve already pre-skewed it.

Four: “these results were calculated by using a dollar amount invested into Standard & Poor’s (S&P) 500 Index . . . and comparing it to the same dollar amount to purchase a vehicle.” What dollar amount? Compared to the S&P when? Over which time period? For how long?

Essentially, what Kwik-Lift did was take the cars in question, see what they sold for new from the dealer back in the day, see what B-J auctioned them for, and calculated the percentage gain over the years. Compare that directly against what Standard & Poor’s would have done over the same period of time, and abracadabra, a 1968 L88 Corvette is a “good investment.”

But here’s the thing: of course it looks like a better investment than the stock market in hindsight. In hindsight.

Money Talks

Back in 1950, Jackson Pollock painted Lavender Mist, an enormous abstract expressionist painting that hung in Peggy Guggenheim’s gallery for months with a price tag of $10,000. It finally sold, off the books, for around eight grand (if I’m remembering this right). And yeah, eight-large could have bought you a house back then, but still, do you know how much a Pollock of this caliber goes for today?

Hundreds of millions of dollars. Hundreds.

The point being, sure, you could have made a lot of money buying low back in the day and selling (very) high in the present day on something that is currently very desirable. But how do you know what you can buy today that will be seriously valued 50 years from now? You can’t, that’s the answer to that question.

Which is why serious investors, people who invest money for a living, people who own banks, for example, do not put their money in big block Corvettes, short wheelbase 911s or abstract paintings hanging in galleries in Manhattan. You know where they put their money? In banks. In the stock market. In the Standard & Poor’s 500. In real estate. That’s where you invest money, not in cars. You don’t make money with cars, you spend money on cars.

Tony Borroz has spent his entire life racing antique and sports cars. He is the author of Bricks & Bones: The Endearing Legacy and Nitty-Gritty Phenomenon of The Indy 500, available in paperback or Kindle format. His forthcoming new book The Future In Front of Me, The Past Behind Me will be available soon. Follow his work on Twitter: @TonyBorroz

Cover Photo: 1970 Pontiac GTO by Darwin Holmstrom, from the book Pontiac GTO 50 Years also authored by Holmstrom.

from Automoblog.net https://ift.tt/2mFuoRV

No comments:

Post a Comment