It’s seems like every generation in the United States has caught sport utility vehicle fever. SUVs sell like hotcakes and it makes sense. SUVs are that super-practical, do-anything machine for the 21st century. It’s not uncommon to hear about baby boomers getting a small SUV in the interest of downsizing, or GenXers opting for something larger and more luxurious as they move through their prime earning years.

Millennials are no exception either as they pass into their formative earning and family-raising years.

And while large, luxurious SUVs have their appeal, their smaller counterparts – often referred to as compact utility vehicles – are catching on with younger buyers.

“We see the emerging entry CUV segment growing at a very fast rate and the industry has seen customers looking for CUV body styles over sedans,” said Tyler Graves, Planner – Chief Marketing Manager, Nissan North America. “CUVs offer the fuel efficiency of small cars while offering additional versatility and cargo space.”

“Saving money drives the younger buyer in their choice,” added Michelle Krebs, Executive Analyst, Autotrader. “Smaller vehicles have smaller price tags and sip less gas.”

Untapped Potential

Generation Z, the cohort after millennials, made up 25 percent of the U.S. population in 2015 according to Forbes. Generation Z consists of those born from the mid-1990s to the early 2000s, and is a larger cultural sect than baby boomers or millennials. Like millennials, they are shaping new models of mobility, which sometimes spurs the idea that younger audiences will forgo car ownership all together.

However, a 2016 study on Generation Z from Kelly Blue Book and Autotrader found otherwise. In that study, 92 percent stated they plan to own a vehicle one day.

“They favored Honda, Chevrolet, and Ford as they see those brands as traditional, practical, and trusted,” Krebs explained. “The zero to now 19 crowd will make up 23 percent of the population with $3.2 trillion in purchasing power by 2020.”

“Baby boomers, Gen Xers, millennials – everybody wants their SUV, and Gen Z is no different,” added Erich Merkle, Ford U.S. Sales Analyst.

Ford has studied SUV ownership among the generational cohorts before, and projects that U.S. sales of subcompact SUVs among those 18 to 24 will surpass those of subcompact cars as early as next year. Ford’s research shows that just four years ago, that same age group purchased 8,121 subcompact cars and only 443 subcompact SUVs. Last year the tables turned as those consumers purchased 3,981 subcompact cars and 2,840 subcompact SUVs – a 541 percent leap for subcompact SUVs.

“As more new small SUVs like the Ford EcoSport become available, you’ll see the subcompact SUV segment continue to climb as a popular new car of choice for first-time buyers,” Merkle said.

Ford EcoSport. Photo: Ford Motor Company.

Connected Cultures & Long Roads

Securing a slice of Generation Z pie is paramount for automakers, and the market is now flooded with new CUV offerings pointed directly at today’s youth. In order to further attract them, Ford has made things like in-vehicle Wi-Fi, multiple charging ports, and various smartphone compatible entertainment systems a priority. The new EcoSport is already compatible with Amazon Alexa, Apple CarPlay, and Android Auto.

“To Gen Z buyers, connectivity is everything,” said Karen Sullivan, Ford EcoSport Brand Marketing Manager. “Their car serves as an extension of their phone and their home, and we’re seeing an exciting response from these young customers to our all-new EcoSport.”

Ford is strategic in their engineering and marketing of the EcoSport, focusing on the vehicle’s fuel efficiency, cargo space, connectivity options, and price but Kerbs believes nothing will happen overnight.

“Ford faces a challenge with the EcoSport and has their work cut out in terms of making inroads in the subcompact segment,” she explained. “The EcoSport must establish its name; it currently lacks consumer awareness and the name itself is confused with Ford’s EcoBoost.”

Photo: Ford Motor Company.

Finding The Mark

According to Krebs, the Jeep Renegade, Compass, and Honda HRV are among the strongest competition for Ford, and each see more user traffic on Kelley Blue Book than the EcoSport.

“In our Kelley Blue Book Brand Watch, a metric that measures brand health down to the model level, the Ford EcoSport does not lead in any of the nearly two dozen attributes we measure, including the three most important,” she continued. “Our analysis shows the most important attributes to shoppers in the subcompact utility segment are durability, safety, and affordability.”

Krebs believes Ford should continue to expand their tech offerings for the fledgling EcoSport, but not at the expense of other important aspects younger buyers will inevitably consider. The Kelley Blue Book Brand Watch metric concluded the EcoSport did not offer as many safety features, had lower fuel economy, and was higher in terms of sticker price at $19,995 (destination and other fees not included) than the competition.

“Ford needs to find ways to promote the EcoSport, especially to younger, likely urban buyers, to build awareness,” Krebs said. “They need to focus on the aspects in the segment that matter – especially value – and then layer the technology on top of those basics.”

Photo: Ford Motor Company.

Satisfied Customer

Ford stands by the price point, saying the EcoSport’s 1.0-liter engine with its EPA-estimated 28 combined mpg has already attracted younger buyers.

“I’d never heard of EcoSport, but I loved it the minute I saw it,” said Kelly Oswald, 19, one of the first owners.

Oswald, a suburban Baltimore college student, represents a growing link between Generation Z and subcompact SUVs. Last year, 11.3 percent of those 18 to 24 who purchased a new SUV purchased a subcompact one, up two percent from five years earlier.

“I went in looking to buy an used car,” she continued. “I didn’t expect there to be an affordable option to buy a new car.”

Although Oswald may be ahead of the curve.

“That age group, regardless of generation, does not typically buy a new vehicle for a first car,” Krebs said. “They generally drive an used car that might be a hand-me-down from their family.”

2018 Nissan Kicks: Photo: Nissan North America.

Kick Start

The Nissan Kicks, another new entry, was introduced last year during the Los Angeles Auto Show as the sixth member of the company’s SUV and crossover lineup. The S trim begins at $17,990, the SV at $19,690, and the SR at $20,290. The Kicks is standard with Automatic Emergency Braking, RearView Monitor, and seven air bags. SV and SR grades add Blind Spot Warning and Rear Cross Traffic Alert.

“The new Kicks is designed to fit the needs of singles or couples looking for expressive styling, personal technology, smart functionality, and advanced safety features at an affordable price starting under $18,000,” explained Michael Bunce, Vice President, Product Planning, Nissan North America, Inc.

Although, like the EcoSport, the Kicks faces an uphill battle in its newness.

“It’s becoming very crowded with entries,” Krebs said of the CUV segment. “There are some all-new ones – Nissan’s is the Kicks – but also some that have been there for a bit and have stronger brand names.”

Nissan doesn’t dispute the market’s little breathing room but remains confident.

“The segment is becoming increasingly competitive with new entrants,” Graves said. “However, we’re very optimistic about Kicks and the value we’re able to offer customers.”

Photo: Nissan North America.

Forward Looking

According to the automaker’s U.S. sales report for May 2018, overall sales of Nissan crossovers, trucks, and SUVs were up four percent. The Rogue lead the way, with a May record of 38,413 units, up 18 percent. However, Nissan noted that total May sales stood at 131,832 units, a decrease of 4 percent compared to 2017.

The Kicks, as it is just arriving, was not included in the report, although a long-term strategy is in play.

“We expect Kicks buyers to have a great experience with the safety and technology that we are offering,” Graves said. “We believe that Kicks will attract younger buyers and we hope to see them eventually move up our lineup as their needs progress.”

The Kicks tops the EcoSport in EPA fuel economy ratings (33 mpg combined versus the aforementioned 28) and has a lower price point, beginning just under $18,000 versus near $20,000 for the EcoSport. The Kicks is one of the best offerings in the segment in terms of these two factors.

Photo: Nissan North America.

Combined Approach

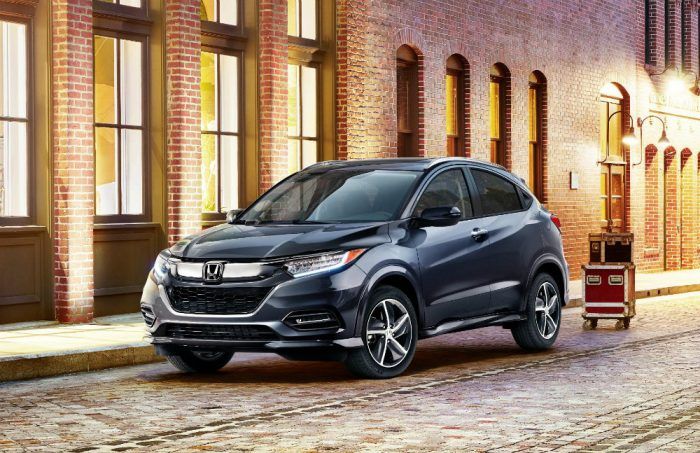

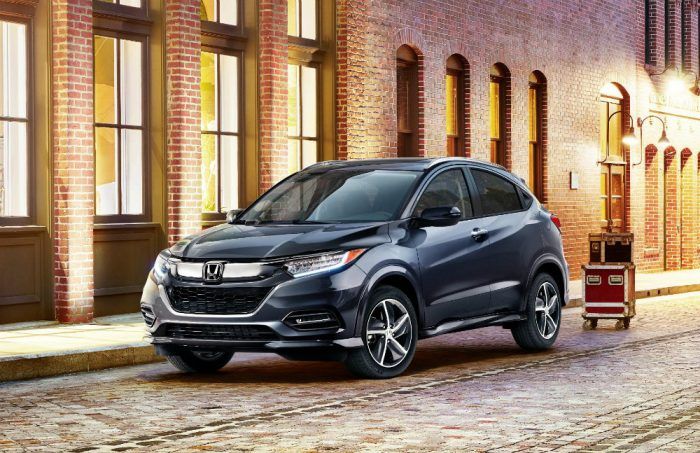

The Honda HR-V, although still relatively new, is a bit more established, having been on the market for three years now. While the HR-V is pointed toward Generation Z, Honda has taken into account older millennials.

“The Honda HR-V was developed with men and women between the ages of 18 and 34 in mind,” explained Jessica Pawl, Media Relations Manager, American Honda. “The HR-V is designed for people with active lifestyles who want a vehicle that makes their lives easy, but want to enjoy getting where they’re going.”

Honda’s HR-V team went for flexible packaging, efficiency, and overall value when engineering the vehicle.

“It’s fuel efficient, fun to drive, and features advanced safety technology,” Pawl continued. “It’s very well rounded and affordable, featuring the dynamics of our best sedans and the functionality of our most practical cars.”

“The HR-V benefits from the very strong brand image of Honda,” Krebs added.

The 2018 HR-V starts at $19,570, with two-wheel drive models earning an EPA-rating of 31 combined and all-wheel drive variants coming in at 28 combined. The HR-V was the number two seller in the segment last year, being edged out by the Subaru Crosstrek. Honda’s long-term strategy is similar to Nissan’s.

“Honda’s balanced portfolio offers buyers the opportunity to grow within the brand, moving up in vehicle size as their family grows and needs adjust,” Pawl said.

Photo: Honda North America.

Future Considerations

CBT Automotive Network notes in this January feature that Generation Z is more tech oriented than millennials and will likely not recall a time without Wi-Fi, smartphones, social media, and any number of streaming services. It’s something the automotive industry needs to be cognizant of as they approach this now rather large and significant cohort.

Despite a competitive CUV segment and the potential there for automakers, how many eggs to place in that basket is open to debate. As manufacturers use entry-level CUVs as a means to introduce younger audiences to their brand, it’s important to consider how these buyers, especially Generation Z, differ from others. While automakers have the best intentions, there is no guarantee these younger buyers will remain loyal, especially with so many rising stars in the SUV and CUV universe.

“The segment remains unclear as to how big it will be,” Krebs said. “They definitely want to own a car, but counting on Gen Z to drive sales of any new vehicle is misplaced, particularly in light of how cost-conscious they are.”

Carl Anthony is Managing Editor of Automoblog and resides in Detroit, Michigan. He studies mechanical engineering at Wayne State University, serves on the Board of Directors for the Ally Jolie Baldwin Foundation, and is a loyal Detroit Lions fan.

Photos & Source: Ford Motor Company, Nissan North America, Honda North America.

from Automoblog.net https://ift.tt/2Nf2l7U